An affordable route to data-driven customized insurance

One driver is not the other. All insurers will agree. There are several methods of categorizing individual drivers into risk profiles, but few of them lead to Usage-Based Insurance (UBI) in a cost-effective way. In addition, data collection at an individual level poses many privacy challenges.

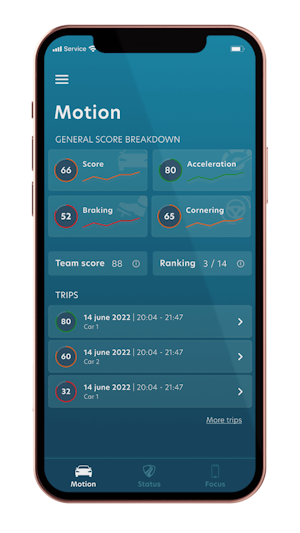

SafeDrivePod allows insurers to monitor only the most relevant variables of driving behavior per driver, significantly reducing the impact on privacy. A variable insurance rate is usually based on things such as the number of kilometers to be driven, a general risk profile and/or age. By using SafeDrivePod, this can be expanded with crucial variables for estimating risks, such as driving time and the intensity of braking, acceleration and steering movements.

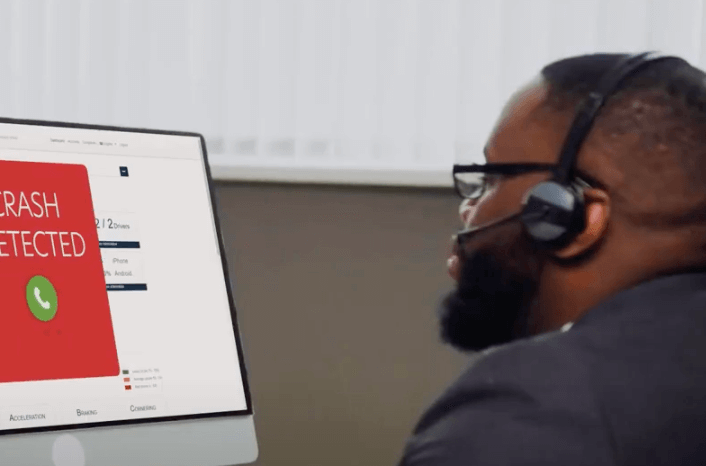

Monitoring and subsequently actively encouraging safe driving usually leads to fewer accidents. Our solution for limiting smartphone use in traffic fits in seamlessly with this. In addition, SafeDrivePod enables insurers to reward good driving behavior and retain contractors with a favorable risk profile. SafeDrivePod fits in well with the pursuit of a 'clean' wallet.